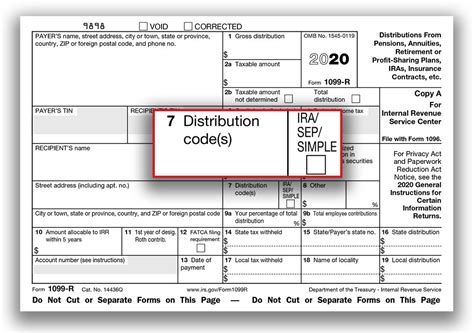

what does distribution code 7 in form 1099-r box 7 Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over .

With 100 years of experience, GKD provides the complete service you are looking for in your next architectural project. With over 50 different weaves that meet both form and function, in a variety of colors, textures, surfaces, and customizable attachment systems, we are your solution.

0 · irs distribution code 7 meaning

1 · irs 1099 distribution codes

2 · irs 1099 box 7 codes

3 · distribution code 7 normal

4 · distribution code 7 non disability

5 · 7d distribution code 1099

6 · 1099 box 7 code m

7 · 1099 4 box 7 codes

Source over 699 junction boxes for sale from manufacturers with factory direct prices, high quality & fast shipping.

irs distribution code 7 meaning

metal fabricators in mentor ohio

The code (s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Enter the information on your 1099-R as it . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, .

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over . L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

Box 7 on Form 1099-R contains distribution codes that help taxpayers and the IRS understand the nature of the distribution. These codes are essential for accurately reporting the distribution on the taxpayer's tax return .

Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be checked .You are not . 1099-R Form Distribution Code Box 7 - G Question Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non . The X between boxes 7 and 8 is not the box 7 code. The box 7 code is a letter (other than X) or an number, or a combination of two letters/numbers. When the box 7 code is 7, some people get confused and do not recognized that 7 is the code. Code 7 means that the distribution was made after reaching age 59½.

irs 1099 distribution codes

Double check Box 7 and the IRA box on your 1099-R. How will this impact my return? The distribution codes and IRA box describe the type of distribution. The program relies on these codes to make correct calculations. The distribution codes are found in box 7 of Form 1099-R. The IRA/SEP/SIMPLE box is usually located right next to box 7. If box number 7 (distribution code) is blank on my 1099-R form what should I do? US En . United States (English) United States . (distribution code) is blank on my 1099-R form what should I do? . Is there an appropriate code somewhere near box 7 that's slightly misplaced? October 10, 2021 6:32 PM. How was Box 7 of your Form 1099-R coded? You should enter each Form 1099-R exactly as shown. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them.However, any interest you receive is taxable and you should report it as interest received. 1099-R with code 3 in box 7 for a disability pension at an age younger than the minimum work retirement age... since these distributions are taxed as wages until you reach the minimum retirement age and reported on line 7 of the 1040, this would be considered earned income and if that total is above ,500 (or ,500 if over 50) you could fund an ira for that tax .

Form 1099-R, Box 7 codes. Retirement. Form 1099-R, Box 7 codes. The following are the instructions for the 1099-R, Box 7 data entry and what each code means. . If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. .

The IRS defines disability for the 1099-R as follows: "(7) Meaning of disabled. For purposes of this section, an individual shall be considered to be disabled if he is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or to be of long-continued and indefinite . Yes, lauren-s you should see the full amount being included on Form 1040 line 4d and in taxable income. Make sure that when asked in the questions that followed entering the details of the Form 1099-R that you indicated the type of Roth account (either Roth IRA or Designated Roth Account in a 401(k), 403(b), etc.) to which you rolled over the distribution.

A common distribution code used in Box 7 of Form 1099-R is code 7, which indicates a normal distribution. This means that the distribution was made after the account holder reached the age of 59 and a half, and is generally not subject to early withdrawal penalties.1099-R Codes for Box 7. Haga clic para español. Revised 01/2024. Box 7 Code. . Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the participant is at least age 591/2 . Using Turbotax Desktop, Feb 23 2022 update, entering 1099-R for an inherited IRA (from 2018 so using 10 year withdrawal plan). 1099-R entered exactly as printed on 1099-R: boxes #1, 2a, 2b (Taxable amount not determined), #4 0.00 -- results in, initially a 28% tax, but after entering code 4 in box 7, and checking of the IRA/SEP/SIMPLE box, all taxes go to "0". A regular distribution from a Roth IRA would be reported on Form 1099-R would be reported on Form 1099-R with either code J, T or Q depending on your age, and how long you had the Roth IRA. Since the incorrect Form 1099-R had code 7, presumably you are over age 59½, so a distribution from a Roth IRA would be coded with T unless you had the .

The box 7 code was "J". . penalty on a 2021 Form 5329. The code-J distribution in 2022 corrects this excess and will reduce the ,000 excess carried into 2022 from 2021 to zero on the 2022 Form 5329. 2) Yes, codes J and P are correct for the return of the excess contribution for 2021. . the 2022 Form 1099-R with codes P and J for the . What is Code 6 on box 7 of 1099-R? Code 6 is a "Section 1035 tax-free exchange." Section 1035 is a financial transaction in which a life insurance or annuity policy is replaced for a new one without any taxable event (Basically, it just means replacing one annuity contract for another annuity contract with identical annuitants.).

B and 2 are two separate codes and must be entered individually in the two drop-down boxes on TurboTax's 1099-R form. Codes B and 2 together mean that the distribution was from a Designated Roth Account in a qualified retirement plan (B) but is not subject to an early-distribution penalty despite you having been under age 59½ at the time of the distribution (2).Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. Code Explanation Used with, ifapplicable 1 (1) Early distribution (taxpayer is under age 59-1/2) and . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another account. By knowing what each code means, you can accurately report your distribution on your tax return. . If there is no code or number there, you should contact the Payor to get a corrected 1099-R. Here's some info about the codes in Box 7: The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions, to determine if your distribution is taxable or subject .

Code F is not for a distribution paid directly to charity. Code F indicates a payment to YOU from a charitable gift annuity. A charitable gift annuity is not an IRA. You are not permitted to change the code from what the payer provided on the Form 1099-R. Does the Form 1099-R provided to you by the payer have code F in box 7? I suspect not. Hi! I received a distribution for excess contributions last year (t/y 2020) for a small amount. I also received a 2020 1099-R with the gross distribution, taxable amount, and the small Fed and State Taxes withheld. Box 7 has code PJ; so . Codes 1 and M are separate codes in the same box 7 and each code must be selected separately in the two box-7 drop-down boxes of TurboTax's 1099-R form. The code 1 on each of the forms indicates that each of these distributions is subject to a 10% early-distribution penalty unless rolled over to another retirement account or you have a penalty . The purpose of Form 8606 (Part III) is to compute the amount of UNQUALIFIED distributions from Roth IRAs that is taxable. If your 1099-R shows code J or T, TurboTax will assume that the entire distribution shown in Box 1 is an unqualified distribution.

I agree, there should have been no code L1 2019 Form 1099-R since the loan was satisfied by the 2018 offset distribution reported on the code M1 2018 Form 1099-R and you had no loan in 2019 on which you could have defaulted in 2019. You need to obtain a corrected code L1 2019 Form 1099-R from the payer showing When the Form 1099-R reporting a distribution from a traditional IRA (IRA/SEP/SIMPLE box is marked) has code 2, the Form 1099-R is typically reporting a Roth conversion. The only other reason that in 2020 code 2 might be used is if the custodian is indicating that the distribution is a Coronavirus-Related Distribution, but IRA custodians . distributed.The code M in box 7 of this 2019 Form 1099-R indicates that the offset distribution that satisfied the loan occurred in 2019 and that you have until the due date of your 2019 tax return, including extensions, to come up with the money to roll over some or all of this distribution and continue to defer this income, avoiding income tax and avoiding the 10% early-distribution penalty .

FTTH fiber optic distribution boxes are critical to your FTTH solutions. If you are looking for high quality fiber distribution boxes that reduce your cost to deploy then look no further. FiberCheap brings simple and easy to replicate FTTH fiber termination boxes direct from our factory to you!

what does distribution code 7 in form 1099-r box 7|irs 1099 distribution codes