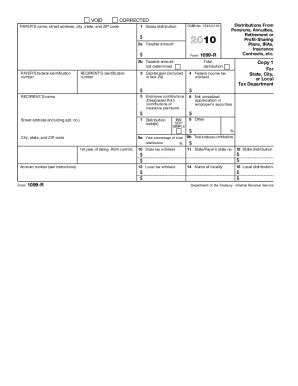

1099 r distribution box 1 Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom . $7.99

0 · what is a 1099 r for tax purposes

1 · 1099 taxable amount not determined

2 · 1099 r profit sharing plan

3 · 1099 r gross distribution meaning

4 · 1099 r exemptions list

5 · 1099 r distribution from pension

6 · 1099 r boxes explained

7 · 1099 r 2a taxable amount

Voigt’s Sheet Metal Works, Inc. is a family company proud of their growth in the past sixty years. Offering quality products, the most technologically advanced equipment and knowledge, hardworking personnel, Voigt’s guarantees the best service in South Georgia!

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

File Form 1099-R for each person to whom you have made a designated distribution .Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From .Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom . Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a .

Check out your 1099-R's gross distribution (box 1) and taxable amount (2a) from each of your retirement income sources. You'll likely need to copy over these amounts to their . Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan.

what is a 1099 r for tax purposes

Form 1099-R example. The 1099-R form looks like this: On the left, you’ll find the payer’s taxpayer identification number (TIN) and their contact info. On the right, these are the . I have a client who received a 1099-R form in 2023 with a distribution code of P. Box 1 is a 280K+ amount, box 2a is 3K+ amount, with federal and state taxes withheld. Should . My client received a 1099 R showing a gross distribution of ,000.00. He had actually taken out ,000.00 from his IRA in October 2020 for personal reasons and made a .

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the .If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.

Check out your 1099-R's gross distribution (box 1) and taxable amount (2a) from each of your retirement income sources. You'll likely need to copy over these amounts to their relevant lines on Form 1040. Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan. Form 1099-R example. The 1099-R form looks like this: On the left, you’ll find the payer’s taxpayer identification number (TIN) and their contact info. On the right, these are the main boxes to pay attention to: Box 1: Gross distribution — This is the total amount of money you received from your retirement account during the tax year . I have a client who received a 1099-R form in 2023 with a distribution code of P. Box 1 is a 280K+ amount, box 2a is 3K+ amount, with federal and state taxes withheld. Should a separate 1099-r form with code 8 been received? or is everything correct with this single form. how do I report the amounts? 1.

My client received a 1099 R showing a gross distribution of ,000.00. He had actually taken out ,000.00 from his IRA in October 2020 for personal reasons and made a contribution of ,000.00 in November.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution. 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.

Check out your 1099-R's gross distribution (box 1) and taxable amount (2a) from each of your retirement income sources. You'll likely need to copy over these amounts to their relevant lines on Form 1040.

Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan. Form 1099-R example. The 1099-R form looks like this: On the left, you’ll find the payer’s taxpayer identification number (TIN) and their contact info. On the right, these are the main boxes to pay attention to: Box 1: Gross distribution — This is the total amount of money you received from your retirement account during the tax year .

I have a client who received a 1099-R form in 2023 with a distribution code of P. Box 1 is a 280K+ amount, box 2a is 3K+ amount, with federal and state taxes withheld. Should a separate 1099-r form with code 8 been received? or is everything correct with this single form. how do I report the amounts? 1. My client received a 1099 R showing a gross distribution of ,000.00. He had actually taken out ,000.00 from his IRA in October 2020 for personal reasons and made a contribution of ,000.00 in November.

1099 taxable amount not determined

Established in 1946, Voigt's Sheet Metal has grown to be one of the largest, oldest and most reputable Metal Fabrication & Crane Rental companies in South.

1099 r distribution box 1|1099 r profit sharing plan